Data Driven Lending. Globally.

The Infrastructure for the Next Generation of Private Credit

Real-time lending data. Embedded payment flows. Verifiable performance.

EMBD connects high-growth lenders to global capital - securely, transparently, and at scale.

$16M+

Capital Deployed

99.8%

Data Accuracy

30M+

Data Points

2025

Founded

Market Architecture

Global Capital Marketplace

Connecting diverse capital sources with vetted lending portfolios through our institutional platform

Market Solutions

Fund Managers

We partner with leading fund managers in emerging markets through the data infrastructure powering the next generation of private credit.

- Scale capital faster with institutional co-investments

- Automate monitoring & reporting to LPs and noteholders

- Digitize and de-risk your lending portfolios through continuous data intelligence

Data Driven Due Diligence

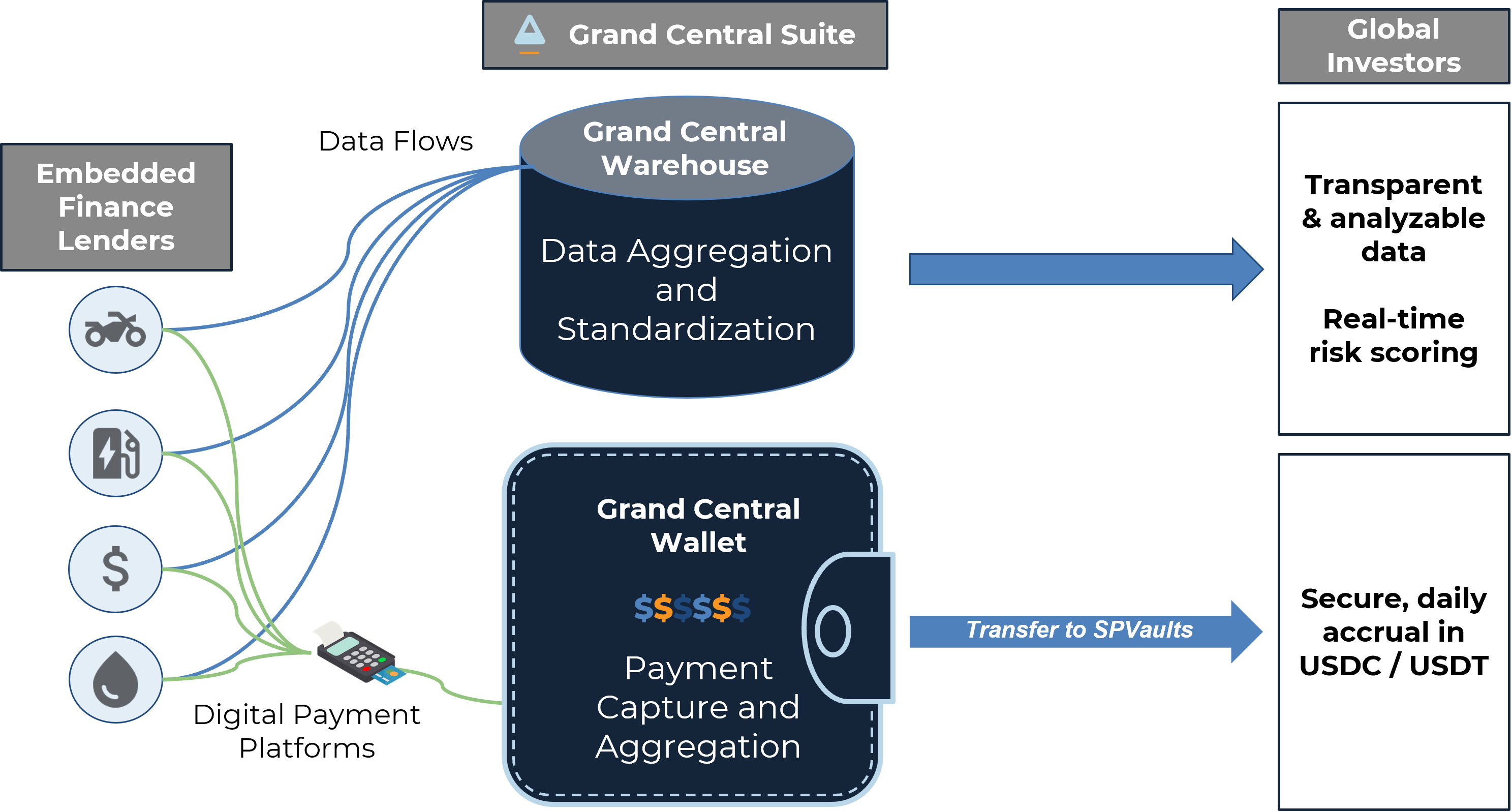

The grand central suite De-risks investments in emerging markets

- Real time operating and financial data integration with investees

- Payments Integration with investees ensuring timely collections

Marketplace Readiness

The Grand Central Suite also comes with management solutions

- Automated document repository for streamlined subscriptions

- Accounting intelligence for fund managers

Platform Capabilities

Institutional-Grade Infrastructure

Three pillars of technology transforming private credit markets

Real-Time Data & Intelligence

- Standardized financial and operational data

- Portfolio-level and company-level risk scoring

- LLM-powered natural-language analytics (RAG)

Embedded Payments Integration

- Automated cash-flow sweeping

- Verified repayment data directly from the source

- Secure rails into capital accounts

Capital Access & Syndication

- Marketplace connecting global capital to vetted fintech borrowers

- Deal transparency + risk monitoring + verified yield performance

Platform Interface

Institutional Dashboard

Our comprehensive platform provides real-time portfolio monitoring, risk analytics, and capital deployment tools in a single, unified interface.

Real-Time Portfolio MonitoringLive performance tracking across all lending portfolios

Advanced Risk AnalyticsPortfolio-level risk scoring and stress testing

Repayment derisking toolsDerisk your portfolio with our repayment integration